Table of Content

All programs that are offered on a state level are offered by the same organization that has detailed information about each program. The programs usually offer a mortgage loan with down payment assistance as a second loan. The first loan has similar characteristics of a conventional loan while the second loan is a no-interest deferred loan. If you’re willing to purchase a home owned by the state of Maryland, this program could eliminate your student debt. To qualify, you must have at least $1,000, but no more than 15% of the home’s purchase price, in student loans.

FHA loans ask there be at least six payments made, or 210 days that have passed since the original date of the existing mortgage. Like a conventional loan, VA loans are issued by private lenders like banks or mortgage companies in the Maryland, but they're insured by the government. VA loans are specifically guaranteed by the Department of Veterans Affairs. That means the VA agrees to repay a portion of the loan to the bank if you don't make your payments or if you face losing your home . MMP home loans are available as either Government or Conventional insured loans. Government loans can be guaranteed by the Federal Housing Administration , the U.S.

Home Buying Programs That Help

According to the Department of Housing and Urban Development, a “first-time home buyer” is anyone who hasn’t owned a home in the last three years. Thus, even if you’re not technically a “first-time” home buyer, you may still be eligible for many local programs and grants. Please note that some homebuyer education courses have a cost for registration.

Some employers, home builders, real estate developers, community organizations and local governments offer their own financial assistance programs for home buyers. If you get financial assistance from another organization and choose a Loan Assist mortgage, the state of Maryland will match those funds up to $2,500. Partner Match funds are provided in the form of a no-interest deferred loan, so no payment is required until the mortgage is paid off. Offered by Baltimore County, the Settlement Expense Loan Program provides financial support to low- and moderate-income, first-time homebuyers. The County government may lend up to $10,000 to income-eligible borrowers to help pay closing costs when buying an existing home within Baltimore County.

Flex Program

The Maryland SmartBuy mortgage will pay off your student debt if you purchase a state-owned home. The HomeCredit program provides a tax credit equal to 25% of your mortgage interest, up to $2,000 a year. Although the HomeCredit program involves both state and lender fees, it could save you tens of thousands of dollars over the life of the loan. While the above programs are strictly available for first-time homebuyers, there are other statewide programs to assist individuals looking to move from one home they have owned into another. Another great option to consider if you have outstanding student debt is the Maryland SmartBuy mortgage. It helps you get rid of all of your remaining student loan debt.

Once the loan is approved with your lender, the lender will reserve funds directly with DHCD. Lead Hazard Reduction Grant and Loan ProgramLoans and grants to assist homeowners and landlords lessen the risk of lead poisoning. Emergency Roof Repair ProgramForgivable loans for roof repair or replacement to homeowners who are aged 62 and older or who have disabilities. HUD requires that you sign asecond mortgage and notefor the discount amount. No interest or payments are required on this “silent second” provided that you fulfill thethree-year occupancy requirement.

Find the right loan

Detailed regulations, policies and procedures govern the programs. For additional information or to schedule an appointment to file an application, contact the Housing Rehabilitation Program staff. Reduced rate, no PMI loan for purchase and purchase/rehab in certain neighborhoods of Baltimore City. Eligible Single Family homes located inrevitalization areasare listed exclusively for sale through the Good Neighbor Next Door Sales program. Properties are available for purchase through the program for seven days.

No advertisement or solicitation from buyhomeprogram.com is meant to be a mortgage brokering activity or mortgage lending activity. All brokering or lending activities can only be completed by licensed real estate professional. All information, home buying programs are subject to change without notice. Always consult an accountant or tax advisor for full eligibility requirements on tax deduction. Buyers must have qualifying income, meet minimum lender credit score requirements and occupy as primary residence.

The Mortgage Assistance Program can be used in conjunction with a mortgage from the Federal Housing Administration and the Department of Housing and Community Development Maryland Mortgage Program. The Office of Homeownership offers a variety of incentive programs to homebuyers purchasing in Baltimore City. These incentives can make buying a home more affordable by lowering your closing costs and boosting your downpayment. Borrowers who qualify for this program receive 4% of the mortgage amount to use for a down payment or toward closing costs.

The length of the freeze depends upon the amount of the expenditure in relation to the pre-improvement market value of the property. In 2006, this program was expanded to include not only the Canal Place Preservation District, but also all National Register of Historic Districts within Cumberland. Maps of these districts are available on our Historic District Maps page. Application forms are also available by emailing Kathy McKenney, Cumberland’s Historic Planner at

This program is being funded by Montgomery County to help working families and first time home buyers to achieve affordable homeownership in Montgomery. The program provides DPA in the form of a second lien no-interest deferred loan, and the funds can be used towards down payment or closing costs. Talking to a lender may be helpful to learn whether you are eligible for the program and how you can benefit from it the most.

For example, your employer, homebuilders, or real estate developers may offer alternative financial assistance programs for new buyers. Marylanders residing in Anne Arundel County will want to visit the municipal website to learn more about the ACDS Mortgage Assistance Program for first-time buyers. This program is specifically for first-time homeowners living in the county. The program provides deferred loans to first-time homebuyers to assist with down payment and closing costs.

Department of Agriculture through the USDA Rural Development Guaranteed Housing Loan Program. Applicants with credit scores of 640 or higher receive streamlined processing. Those with scores below that must meet more stringent underwriting standards.

These include FHA Loans, VA Loans, USDA Home Loans, and loans from the Good Neighbor Next Door Program. You’ve Earned It Mortgage offers a discounted interest rate and $5,000 of assistance to borrowers with $25,000 or more in student loan debt purchasing a home in certain areas. Down payment and closing cost assistance, including non-repayable grants. A USDA home loan is a zero-down-payment mortgage for eligible rural and suburban home buyers.

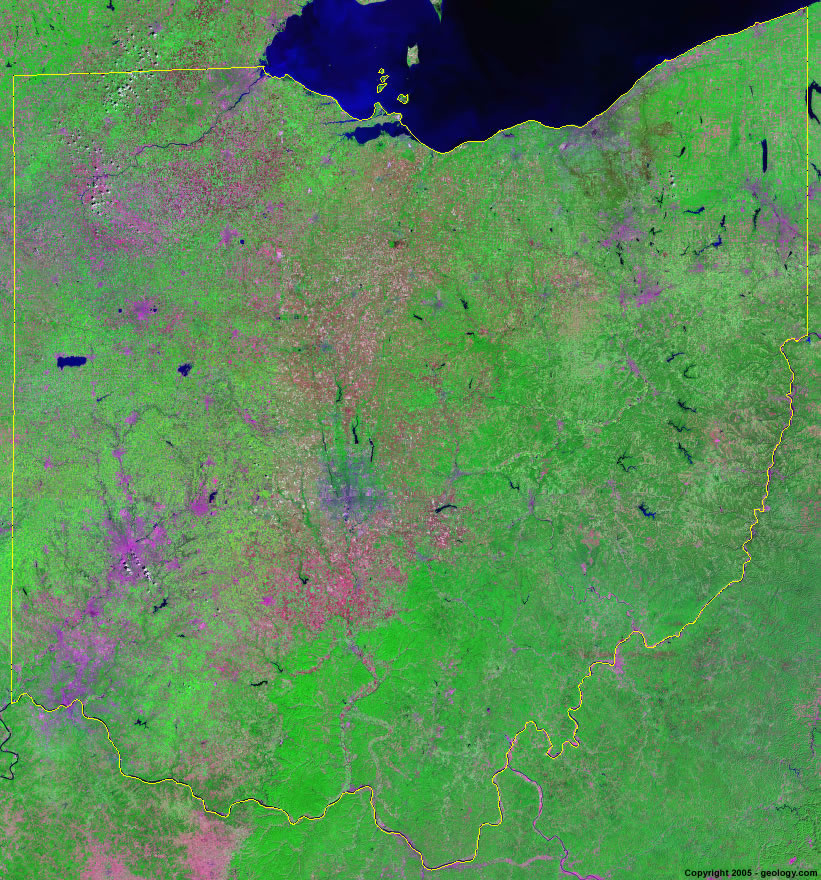

If you’re purchasing in Calvert, Carroll, Cecil, Charles, Howard, Queen Anne’s, St. Mary’s, Talbot, or Worcester County, there are no properties within a Targeted Area. If you’re purchasing in Baltimore City, or in Allegany, Caroline, Dorchester, Garrett, Kent, or Somerset County, then all properties are within a Targeted Area.